Full Car Insurance in a few clicks!

Get a Quantum Motor Insurance Quote – It’s Fast and Easy

- Choosing the right car insurance can be tough or a hassle. Quantum Insurance makes it easier with a fast and secure online quote that will help you compare and choose from our car insurance plans.

- Discover our selection of extra covers as you tailor your insurance cover to match your needs.

Pay Only for What You Need and No More!

- You can always personalise your quotation on line and we will securely save all your details to get you back to where you left your quotation.

- Your quotation will be made accessible to you online 24/7.

- Buying your insurance online will save you time and even more…., as you will receive your vehicle Insurance Policy documents in real time online and in a digital format.

- Our secure online payment system also uses the latest high end technology for a safe transaction experience.

If you need more time to decide, you can always save your car insurance quote on our secure system and it will remain valid for the next 30 days. You may always come back to it any time convenient for you.

Once you’ve decided on the best cover that suits you, buying your car insurance online any time you like, 24/7 is a simple hassle -free process. Our secure payment system provides for a safe transaction experience as your security matters to us. You will also save time as you will receive your vehicle Insurance Policy documents in your electronic mailbox and in a digital format.

If you prefer to buy your vehicle insurance over the phone, just call one of our car insurance experts and we’ll be happy to help. You may also walk into our office in Ebene Cyber City and buy your insurance right over the counter. Whatever be the method you chose, you’ll receive your policy documents instantly.

Documents required to finalize your policy

- National Identity Card /Valid Passport

- Driving licensce

- Proof of address

- Horsepower or deed of sales registered

- Claim History of Main Driver

Save

Time = Money!

- Instant motor insurance quotes that save you time and much more…

- We cut out the middleman so we don’t have to account for agency commissions in your premium. So we passed on those savings to you.

- Opt for a designated driver car insurance policy (Named Driver).

- Go-Green and receive your documents in a digital format by mail (paperless discount).

- Adjust your Excess and you’ll pay less.

Save

Time!

- Get instant free quotes.

- Buy securely online, it takes just a few minutes.

- Print out your car insurance certificate immediately.

- It’s quick and simple for you to make a claim

Get

peace of mind!

- We’re here to help you if you’re involved in an accident.

- Pick up the phone to speak to one of our helpful insurance experts.

- We’re upfront and keep you informed.

- Get 24/7 Roadside Assistance.

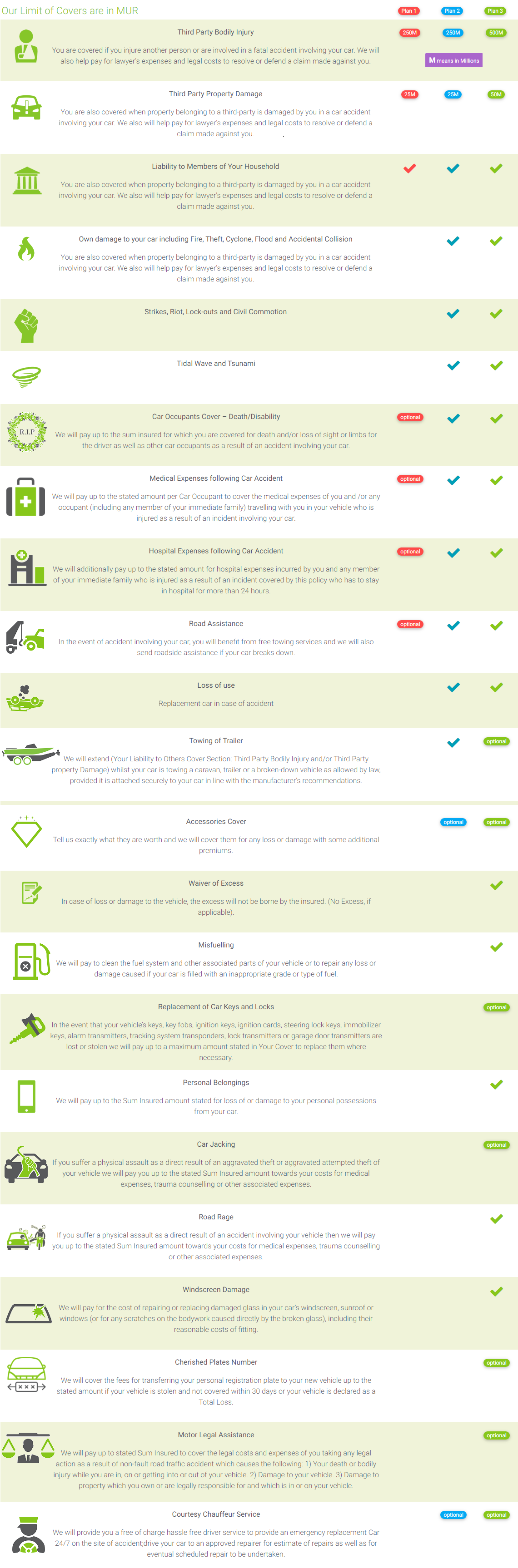

Compare Our Plans

With optional extras to choose from, you can tailor your insurance policy at competitive prices for more coverage.

All your extras at a glance:

Accessories

Not in built accessories Limit: Value of Accessories

Adjust your excess

You can make a saving on your premium by reducing it further whilst opting to review upward your policy excess applicable to your car.

Car Jacking

Medical expenses from physical assault as a direct result of an aggravated theft or aggravated attempted theft of your vehicle Limit: MUR 10,000 per seat

Cherished Plate

Fees for transferring your personal registration plate to your new vehicle in case of total loss Limit: MUR 7,000

Courtesy Chauffeur Service

Free of Charge Driver service in case of accident to: Provide an emergency replacement Car 24/7 on the site of accident. 1.Provide an emergency replacement Car 24/7 on the site of accident. 2.Drive your car to an approved repairer for estimate of repairs. 3.Drive your car to an approved repairer for scheduled repairs. Intervention and Service Only

Hospital Expenses

Hospital expenses following car accident Limit: MUR 15,000 per sea

Loss of use

Replacement car in case of accident Limit: MUR 3,000 per day up to max of 30 days

Medical Expenses

Medical expenses following car accident Limit: MUR 15,000 per seat

Personal Belongings

Lost or damage to personal belongings carried in or on the car Limit: MUR 25,000

Replacement of car keys and locks

The replacement cost of the following items: Provide an emergency replacement Car 24/7 on the site of accident.The door locks and/or boot lock; The ignition/steering lock; The lock transmitter and central locking interface Limit: MUR 50,000

Road Rage

Medical expenses from physical assault as a direct result of a car accident Limit: MUR 10,000 per seat

Towing and assistance

24/7 Road Assistance Intervention and Service Only

Misfuelling

Inappropriate fuel being accidentally put in the car Limit: MUR 25,000

No claim discount

Discount on renewal if there is no claim during the previous period of insurance

Personal Accident

Car Occupant’s Cover Limit: MUR 500,000 per seat

Towing of trailer extension

Third Party Bodily Injury and Third Party Property Damage caused by a trailer/ caravan that is not self-propelled, but is designed to be pulled by a self-propelled vehicle. The limit of liability is the same as the limit of liability of the self-propelled vehicle.

Waiver Excess

No excess in case of accident

Windscreen Damage

Replacement of damaged or broken windscreen (front and rear), windows and/or sunroof (glass) Limit: No Excess